Your home does a lot for you: it keeps you warm and dry, it keeps you safe, and it keeps all your things in one place. Aside from the odd repair or two, it’s holding up and doing its job well.

That’s why it comes as such as shock when your insurance company informs you that your roof age is too old and they are going to drop your homeowners insurance coverage if you don’t get a new one.

Huh?

You know you need to start calling roofers when you have a leak or severe hurricane damage. But the age of a roof and insurance company requirements aren’t typically thought of as reasons for getting your roof replaced.

Which might leave you wondering, “How long does a roof last? Does the insurance company know something I don’t?”

Yes, The Insurance Company Knows Something You Don’t

It should come as no surprise that insurance companies are dedicated number crunchers. They have entire departments dedicated to compiling data on any and every insurable, including roofs.

I can guarantee you that your insurance carrier has detailed data on how long roofs are expected to last, the most common causes of roof-related claims, and which types of roofs are most resistant to damage.

Having the funds available to pay for claims is entirely dependent on the insurance company collecting the right amount in premiums (not enough money coming in + too much money going out = bad business). That’s why insurance fraud is such a big deal.

If your insurance company can predict—as much as possible, anyway—which roofs are likely to have a claim, they can increase premiums for these “riskier” policies and build up a stash for when those claims start rolling in.

So when they send you a notice to either replace your roof or find another carrier, it’s because your roof age fell into the “dark place” in their data, where it simply becomes too risky for them to insure.

How Long Does a Roof Last?

So, according to the insurance companies, how long does a roof last?

There are two main factors to consider when examining the age of a roof and insurance requirements: covering type and roof shape.

Covering Type

Most roofs fall under one of three categories: standard shingles, architectural shingles, or tile.

Standard shingles butt up against each other, giving the roof a flatter, more uniform shape and are expected to last up to 15 years. Architectural shingles overlap each other, giving the roof a more textured, three-dimensional appearance. These are expected to last up to 20 years.

Tile roofing is made of either concrete or clay and comes in different shapes and textures. Tile roofing is typically stronger than shingle and is considered to have a life expectancy of 30 years.

This doesn’t mean that your architectural roof will start collapsing after 20 years. But these guidelines have become standard in the insurance industry so in most cases, your roof age will have to fall within these ranges in order for you to be issued a policy.

Roof Shape

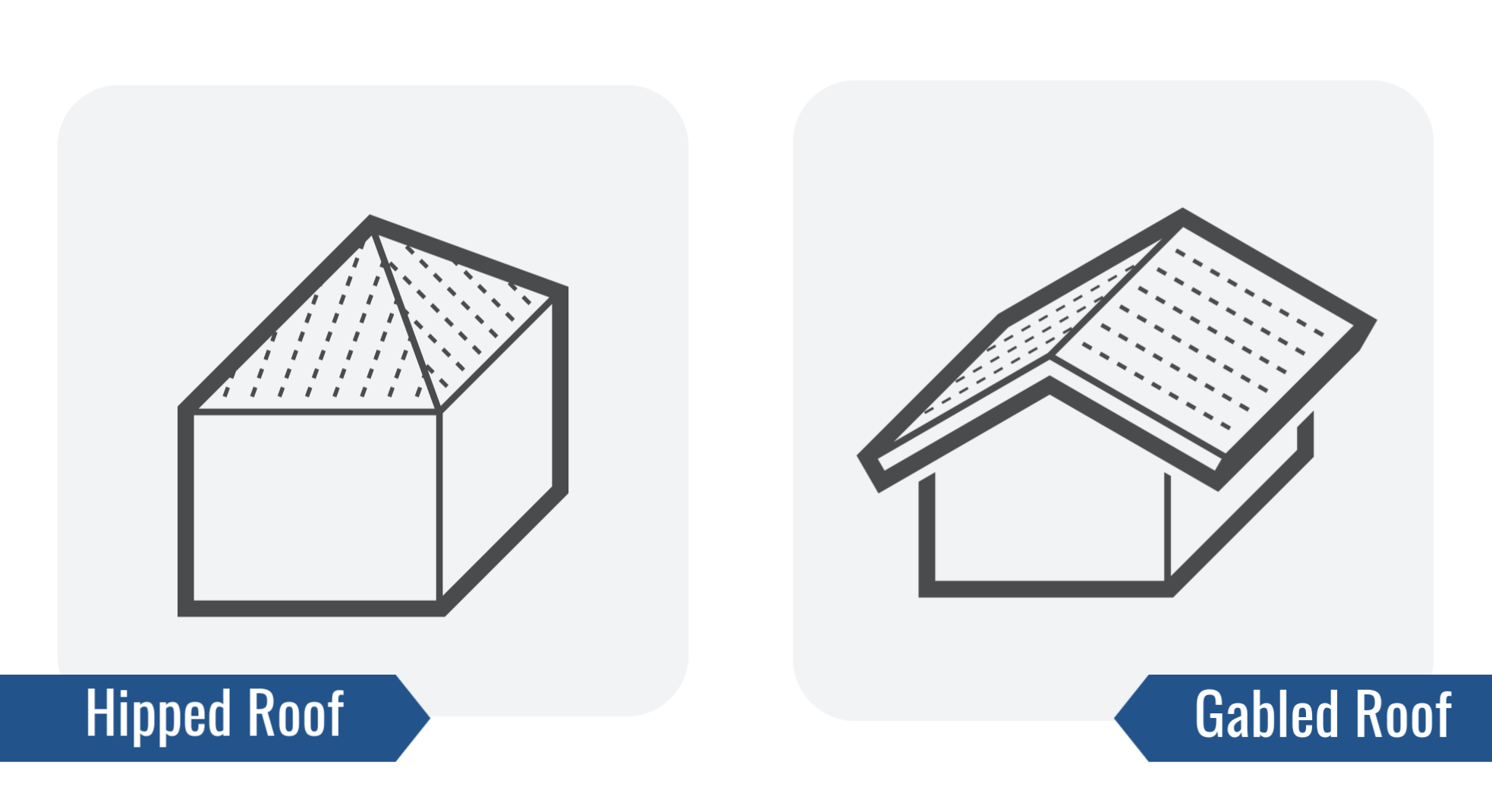

The second thing your insurance company will look at is the shape and slope of your roof. A roof’s shape affects drainage as well as how much wind speed it can endure before damage occurs.

Most insurance companies tend to prefer hip roofs (where all four sides of the roof slope downward), but gable roofs (where two sides slope downward) will still protect you and your family. Flat roofs are rarer in Florida; they are usually harder to insure as they don’t allow rain to run off as easily as other roof types.

Age of Roof and Insurance

Based on the insurance companies’ extensive data, older roofs are more likely to receive serious damage than newer roofs. As building codes and technology evolve, roof quality goes up.

For instance, secondary water resistance, which is a rubber-like, watertight barrier that sits between the shingles and wooden decking, became much more common post-2010. Homes with this extra layer of protection have a much better chance of weathering the next storm unscathed.

The truth is, insurance companies feel much more comfortable with newer roofs and don’t want to open themselves up to more risk than they want to.

This may sound unfair at first, but imagine if you were responsible for 250,000 roofs across an area that was well-known for severe storms. If you had data showing that normal wear-and-tear tends to limit roof age, you would probably make the same demands.

Another factor leading to more roof replacement demands is insurance fraud. Shady roofing companies that fake (or even create) roof damage have led to an uptick in claims that many insurers cannot keep up with. As a result, some companies are requiring that all shingle roofs be replaced after 10 years. If they are not replaced, those companies are either offering less comprehensive coverage or no coverage at all.

It’s All About the Bottom Line

In order to stay in business, your insurance company needs to mitigate its losses. And one of the ways it does that is by refusing to cover roofs that it believes are prone to severe damage.

If you’ve received a notice from your insurance company that your roof is too old, you have two options: 1) have your roof replaced or 2) find an insurance company who will cover it. There are a few insurance companies who will insure 16-year-old standard shingle roofs, but no insurance company will cover your roof forever. At some point, you will simply have to replace your roof.

Yes, even if there’s nothing currently wrong with it.

However, a new roof is a good opportunity to get a wind mitigation inspection. In addition to giving you the peace of mind that your home can better withstand the next big storm, you’ll also save on your insurance premiums.

If you have received a notice that your roof is too old or if you’re looking for homeowners insurance, call Harry Levine Insurance. We pride ourselves on building a customized, comprehensive network of policies so each of our clients feel protected, listened to, and safe.

Comments (47)

zidane

December 7, 2023thank you for making this article very useful and keep up the good work

Vivian Black

April 6, 2022We are starting to need a new roof because we have holes in our shingles. Before I read your information, I did not know the difference between architectural shingles and standard shingles. When you wrote about how the architectural shingles last up to 20 years, that seemed like the best choice for a shingled roof. We live in a harsh climate so our roof is up against a lot of heat and a lot of cold. We will be contacting a roofing contractor within the week to get their opinion on anything else we need to know to get started on a new roof.

Rick Jones

February 15, 2022I understand that an insurance company needs to mitigate its losses. I plan to keep this in mind while looking for an insurance company. Mainly so that I can find a realistic company that will actually help me out.

Elin

November 4, 2021Hello Jason,

May I ask a question? I am considering having solar panels installed on my roof, and I was told by my agent that my current carrier does not cover solar and will actually CANCEL my policy if I have solar installed. Can they do that? This seems so bizarre to me! With the push to move to green energy these days, this seems a little outrageous.

Thank you!

Claire Masters

October 27, 2021Thanks for the information that insurance companies avoid covering roofs that can be prone to damages and claims. This has made me think about this foreclosed house I’m about to acquire as the roofing system is not new. Knowing this, I think I’ll simply buy a property where the previous owner has already ensured the entire house and what I would need to do now is get damage estimation services as a safety plan.

Kaitlin Gregory

May 28, 2021This is very helpful. Your presentation is simply and understandable. i will be sharing these. Thank you for sharing.

Roofer New Orleans

May 28, 2021Great blog. What is your take on Clay roofing.

Ricardo Coronel

May 5, 2021Hi Jason.

I got pre-approved and my offer accepted by the buyer for a house here in Lake Mary. As part of the requirements the lender is asking to quote insurance. I called Progressive and told me that their company in Seminole is required a roof from 2014 !!! . The house I am looking to close has a roof from 2007… Yesterday it was inspected and I was told there was no issue with it.. but know I am worried with this situation.. what should I do? call my realtor and stop the process? thanks

F.Dias

April 19, 2021My 16 year old shingle roof is starting to have problems with insurance. I would like to replace my roof with either another shingle or possibly metal roof. Ideally, I would add solar panels at the time the roof is being replaced. However, I have been told that many insurance companies will not cover roofs with solar panels as the structural integrity of the roof might be reduced. Can you help explain if this is fact or fiction. And if fact, are there insurance options for roofs with solar panels?

Jim

April 17, 2021I am preparing to sell my house in Tallahassee, Leon Co., Florida. It has a 17-year-old standard shingle roof that was installed in Jan. 2004. On the rear of the house is a sunroom with a flat roof with rolled asphalt roofing on it (modified bitumen). I plan to have the flat roof redone prior to sale as it is only a 20-year product, at best. Will the new owner have issues finding insurance for a 17-year-old shingled roof in the North Florida marketplace? The shingles were rated for 25 years when they were installed, so the roof still have about 7 years of useful life per the product rating.

Patrick Mullally

March 29, 2021Our annual homeowners premium has just increased from $2000 to $3000. We live in Brevard County on the mainland, not on any of the barrier islands. Our home was built in 2006 so we have a concrete tile roof that is now 15+ years old. Our broker told us that this premium increase is primarily because our insurer has a 15-year tile roof threshold that our roof has now exceeded. We are shocked by this huge increase! Does this $1000 premium increase based on a 15-year+ tile roof threshold make any sense to you?

Josh

March 9, 2021A major insurer is dropping my coverage because my 12-year-old roof has some moss and a few lifting tiles. I offered to replace the porch roof (which gets more deteriorated due to water falling from the upper roof) and to have the shingles repaired and certified but they insist that I replace the entire roof (large hipped). They sent out a photographer who only used an extension stick for the inspection and couldn’t have photographed the main roof in any detail.

They also called out a couple of very insignificant items (some chips in the bottom 1″ of some siding on a shed from a weedwhacker for example) which seemed silly. I’ve never filed a claim and have insured multiple homes over many decades.

Do they just want to get my house off their books? There were tornadoes south of me last year and their sudden demand seems suspicious. It is hard to understand why they’d give away the $50k in premiums I’d be paying over the next decade.

Thanks!

Jason Levine

March 15, 2021Hi Joshua,

Thanks so much for checking out our blog and reaching out! Bluntly, my guess would be that your carrier does indeed just want to get off of your home as a risk in their portfolio. It’s likely not for any reason having to do you with. They probably just insure too many homes in your zip code or even on your street. I only say this because they’ve pointed out all of the other small “recommendations”. It’s rough right now in Florida, let alone the SOLO (Seminole, Orange, Lake, Osceola) counties. You mentioned your roof is tile. That’s interesting to me, as most of the roof age requirements that have dropped to 10 years or less involve shingles. Tile roof are typically still OK at 12 years, but every carrier is different. I think know the carrier you are talking about. They’re generally on your side, but in many Florida counties they just have a hardline 10 year roof age eligibility factor and they won’t write a home built before 2002.

Our marketplace has been plagued by fraud, and we’re desperate need for tort reform. It’s easy to make the insurers the whipping child, but folks really need to take a look at the trial attorneys and the Florida Senate (who continually blocks good reform and is supported by the trial bar). What we really have is a litigation crisis that is hurting the people of Florida.

Give us a call! It sounds like you might need some minor repairs, but pending those we’ll have options for you!

Thanks,

Jason Levine, MS, CPCU

Jason Levine

February 1, 2021Hi Carlos,

Unfortunately, for insurance purposes the answer is a resounding NO. While more homeowners should have the pride of ownership that you do and care for their castles like you, roof age insurance eligibility guidelines are strictly based on the law of large numbers. The item that matters is your finaled re-roof permit date. If the last roofing permit was 30 years old your roof is 30 years old, and thus it is an insurance eligibility obstacle. If 100 roofs like yours were inspected the vast majority would have major predictable problems. When you couple that with the marketplace litigation and fraudulent claims that run rampant in our state (https://www.insurancejournal.com/news/southeast/2021/01/20/598034.htm) you get what seem like (to folks like you) unfair age restrictions, but they actually make perfect statistical sense. My apologies that I don’t have a better answer!

Thank you,

Jason Levine

Carlos

January 30, 2021I have a tile roof that looks brand new. It is in outstanding condition. Never a leak. People think I replaced it, but it is 30 years old. Is it OK if I hire a company to seal coat it with a special product to give me a 25 years warranty, so in order for this warranty to be presented to the insurance company?

Kayla

October 27, 2020Hi there,

My husband an I are preparing to purchase a townhouse with a shared roof in Broward county Florida. The roof is about 14 years old and flat. The current owner has only sealed it a few times sińce 2006.

Would we need to assume that our insurance will either be dropped or rise after the purchase /closing? Which would then force us to replace it right away.

Jason Levine

November 2, 2020Hi Kayla!

Flat roofs are amongst the hardest to find coverage for, especially in the Tri-County or SOLO areas. The good news is that you’re under 15 years, and depending on the actual material of the roofing system underwriting guidelines may vary. It’s impossible to say what every insurer would do, but you’d be well advised to be aware that you do having an “aging” roof as far as such things go. Give us a call. We can get some specifics and see which companies are available to you!

Best of luck!

Mandy

September 25, 2020Our townhomes HOA is forcing a special assessment on us by deciding that all our townhomes tile roofs be replaced They are in great shape with a few of them needing slight repairs here and there. Is there some kind of an adjuster that will be able to determine how much life is left in our roofs?

Jason Levine

October 5, 2020Hi Mandy,

It’s really hard to say without knowing more specifics. However, your association is within its ability (most likely) and some preventative maintenance expense today might save significant dollars in avoided damage later on. You are most likely at the mercy of the association, which can be both a blessing and a curse in any community like yours.

Thanks!

Afton Jackson

August 31, 2020Wow, I never knew just how much went into the value of roofs when it comes to replacing them and how much they can be covered by insurance. This made me think about the farmhouse that my parents have lived in for a long time and how we plan to help them renovate it from top to bottom. Considering we’ve never renovated it this much before, that roof has been on top of it for as long as I can remember, so I’ll keep your tips about pricing in mind when talking to a roof replacement contractor so we can make the most out of our replacement budget.

Jason Levine

August 31, 2020Hi Afton,

I’m so glad we could provide some valuable information to you and your family! Please feel free to call us anytime to discuss all of your insurance needs!

Jeff R

August 15, 2020Hi Jason,

Excellent article. And exactly what I am in search of as I am trying to understand and reconcile a couple of thing going on with my townhome and HOA here in Orlando. When I moved into the new townhome in 2008 I’m pretty sure the reserve schedule said the roof was to be replaced every 15 years. Eventually it was changed to 17 years. And from 2019 to 2020 the estimated life of our townhome roofs was changed again to 20 years. The exterior walls were also initially to have stucco repairs and repainted every 5 years, then 7, and this year moved to a 8. Coincidentally, the latest letter from the HOA this week says that the insurance premiums are going up for the townhomes. Naturally, my thoughts go immediately to the correlation between extending the life of the roof and the increase in insurance that will be passed along to us townhome owners. And thanks to your article, I can tell you that we have the standard shingles. What insights can you offer about how an insurance company would assess the periodic roof life extensions with the type of roofs we have, and specifically with a 20-year life expectancy now? And how can we make an ROI case to the HOA Board that it would be better to go back to the 15-year roof life expectancy so that insurance premiums can be lowered? I would think that the cost of insuring 20-year old roofs for 264 townhome units is greater than a reserve schedule of a 15-year roof life expectancy. And if you happen to know this — what advantage is there, if any and to which party, to the way that our HOA company set it up this year with a 20-year standard roof life expectancy and higher insurance premiums?

Thank you in advance!

Christina

August 12, 2020Thank you for this information, I received a notification about my roof that is 15 years old and told I was being dropped because of it. As someone who only had two small claims several years ago (washing machine leak, then a year later dishwasher leak) I do not consider myself a high risk client, and have been paying for insurance all this time, shouldn’t the insurance company help finance the replacement of the new roof they are requiring me to have. I mean, isn’t that what the insurance is for?

Jason Levine

August 12, 2020Hi Christina,

Thank you so much for writing us! I have a distinct feeling you’re not going to like my response, but hopefully you can appreciate it. Allow me to explain from an educational standpoint; not through a personal opinion lens. First and foremost, let me make clear that you have done nothing wrong at all. You have, however, found yourself amongst a set of circumstances that stacks the deck against you. You are a victim of our current market conditions.

Your statement, “…shouldn’t the insurance company help finance the replacement of the new roof they are requiring me to have. I mean, isn’t that what the insurance is for?” is one of the most common and fundamental misunderstandings about insurance. The answer is: No. Absolutely not! Insurance is not designed to function like a home warranty. Instead, is the transfer of RISK from the insured (you) to the insurer (insurance company). The insured accepts a known loss in the form of the insurance premium in exchange for the insurer bearing the risk of financial loss (within the terms of the policy and subject to deductibles) that is caused by sudden, unforeseeable, and/or accidental events. Your roof reaching the end of its serviceable life is a routine building maintenance matter. It is not an insurance matter. You are paying your insurance premium to hedge against things like hurricane damage, a lightning strike, fire, etc. Things like replacing a water heater because it is getting old and failing or a roof because it is simply aging and wearing out are building maintenance items. They are not covered insurable losses. They’re just part of owning a home.

Next, let’s fast-forward to your two small claims. Life happens. It’s logical to think, “Well, that’s what I have insurance for.” Unfortunately, you’ve demonstrated a propensity to file small claims. Both of them involved water leaks, and we’re currently in a marketplace in Florida where insurance fraud involving primarily water losses that spiral out of control due to Assignment of Benefits abuse, one-way attorney fees, and upwards of 30x attorney fee multipliers on litigated cases, you are absolutely ultra-high risk from an insurer standpoint. The repeat of plumbing fixtures also speaks, albeit imperfectly, to a propensity for plumbing issues within the house. Maybe it’s time to consider re-piping, maybe’s it not. Over millions of data points (millions of insured homes) the signals are there that your home likely needs some maintenance. Remember, I don’t know the details and I am not intending to insult your castle. I’m just explaining what your insurance company is thinking. It may not seem fair at first pass, but it’s not about you personally. It’s about the data they’ve collected from millions of homes. Your specifics aren’t what they are viewing as actionable or troubling. It’s the collective data that forms their eligibility guidelines. That collective data about those in your circumstances holds quite accurate on the large scale even if it doesn’t actually fit your situation.

Please checkout Insurance Information Institute re: the AOB Crisis: https://www.iii.org/white-paper/floridas-assignment-of-benefits-crisis-031319

Please checkout IRMI re: Attorney Fee issues: https://www.irmi.com/articles/expert-commentary/attorney-fees-for-enforcement-of-settlements-in-florida

All that said, your 15 year roof isn’t the biggest issue. Absent actual damage or a true end-of-life condition it’s insurable. It’s the two water losses within a short period that are your biggest hurdle. If they were beyond 3 years ago that helps. If they were beyond 5 years you are likely in the clear. We’d love to take a look at replacing coverage for your home, autos, and other needs. Feel free to call us anytime!

Jason Levine, MS, CPCU

Linda Chao

August 5, 2020I own a house in another state and have never lived in Florida , but have been helping a parent who owns a house In Sarasota. I blithely changed the insurance company for my parent’s FL house without knowing anything about the FL insurance market, was told to get a 4-Point inspection & then was told by an inspector I hired privately for a full inspection that he deemed the 29 year-old tile roof in a custom built-house, in good condition, to have a life expectancy of less than 5 years, just because “tile roofs only last 25-30 years”. This is despite the fact that half of the neighboring houses, built at the same time (30 years ago) have original roofs and that two homeowners told me that their 30 year-old roofs were in good condition & they expected them to last 40 years. I have been considering going through inspectors until someone says “lifespan of over 5 years”, because I believe that is true for this well-maintained and good quality roof OR changing insurance companies, but your article and responses to other people in the comments section are making me think that maybe I have to accept defeat and replace a perfectly good tile roof with a new one (which also involves several skylights and pool solar panels) in order to keep “good quality” coverage from a major insurance company. I do know of homeowners on the same street who have 30 year-old tile roofs who have kept their insurance (in fact, half of the homeowners) and of neighbors with a 30 year-old roof who changed their insurance and weren’t forced to replace it, but their policy is with a company I haven’t heard of…. Just checking a map…Sarasota seems to be outside of what is considered “Central Florida’…. Is the market the same here? My problem is because I CHANGED insurance companies and so have a NEW policy–is that correct? Should I concede defeat and take steps to replace the roof? Also, once the 4-point report goes in, how much time do the underwriters for the insurance companies give the customer to do something as major as install a new roof? Your article and answers to people’s questions are EXTREMELY helpful. So difficult as a consumer to get this kind of information. Thank you!

Jason Levine

August 12, 2020Hi Linda!

I’m so glad to hear that our blog was helpful to you. The Florida property insurance market is a tricky one at present, and while Sarasota may not be SOLO (Seminole, Orange, Lake, Osceola counties) or Tri-County (Palm Beach, Broward, Miami-Dade), it is absolutely coastal. Coastal counties present unique challenges in our state. They’re often exacerbated due to our legislature’s refusal to pass meaningful tort and other reforms, as the issues aren’t necessarily Hurricanes and Sinkholes.

Regarding your comments on roof age, both sides can be correct. It is certainly possible that a tile roof could last 40 years. My personal home has a tile roof, and it went 32 years before needing to be replaced. The truth is, it really should’ve been at more like 27 years. We foolishly spent as much in maintenance and repairs over the last few years of the original roof’s life as we did on a new tile roof. Insurance industry data is compiled using millions of data points; millions of roofs in this case. Statistically speaking, a tile roof in Florida is going to last 30 years. Some will have a shorter life, and some will last longer. The vast majority will need replacing right at about 30 years. Thus, insurance companies have drawn lines in the sand as regards underwriting eligibility – their willingness to offer coverage – at that point in many cases.

You are correct that if someone has an insurance policy in most instances, but not all, their carrier may continue to offer coverage renewals. It has become nearly universal though, that if a new policy is to be written roof age guidelines are strictly enforced. I appreciate your sentiment, both serious and tongue-in-cheek, and I concur that to “concede defeat” is likely the most appropriate course of action. What you’re actually doing is taking great steps in your pride of ownership and ensuring that your parent isn’t faced with all sorts of issues as the roof reaches end-of-life. If we know that 30 years is the approximate end of service date, then waiting for the roof to start falling apart at 35 years or 40 years will like cost more. The leak that tells you that you have no choice but to re-roof anymore may also cause a serious insurance claim via interior water damage. The worst case scenario is that the leak wouldn’t reveal itself for quite some time leading to a claim denial (for slow/repeated seepage) and out of pocket expenses for your family.

If we can be of any further assistance in helping you protect your parent’s home please don’t hesitate to reach out!

Jason Levine, MS, CPCU

Michaela Hemsley

June 19, 2020Thanks for explaining that standard shingles are supposed to last for around 15 years. I recently noticed that some shingles seem to be falling off of my mom’s roof when I went and visited her the other day. Since I’m pretty sure no one has touched her roof in over 15 years, I’ll have to tell her to look into getting it replaced soon.

Sharon

May 28, 2020Thanks very much for this information. We had not heard from our insurer about a new roof, but it’s about 20 years old and everyone in our subdivision is getting new roofing. Now our insurer is responding as though this is a claim for damage–is that standard?

Jason Levine

June 2, 2020Sharon,

Thank you for your message! Could you please tell me a little bit more about what your insurer is responding to? Did you file a claim? Did you ask them about underwriting eligibility or age restrictions? Please feel to respond on the blog, or you may call or email me privately.

Thanks!

Leonard Rutherford

April 28, 2020The age of roof used in home depends on the quality of the material used in it. Its insurance also depend on it. With the help of your post I came to know all the things related to it.

Jason Levine

April 28, 2020Hi Leonard,

Glad we could help provide some useful information! Please call us anytime if there is anything else we can help you with.

Best wishes,

whirlybird vents nz

April 21, 2020This is a great addition tips blog, thank you for sharing this article. I love it how you have written the insightful, all these about how long does a roof last?: age of roof and insurance. Its all about like a bottom line you must know.

Jason Levine

April 21, 2020Thank you for the kind words! Our main goal is to provide clear and concise information to help non-experts navigate the marketplace!

Candy

February 13, 2020Good Morning Jason

Any insurance co you know of that will cover the house if the proof permit shows replaced 15 yrs ago? e changed ins companies and then after the first month said they were cancelling ins. due to the proof of roof replacement was 15 years ago.

Jason Levine

February 17, 2020Hi Candy,

Thanks for reaching out! A few months ago the answer would have been: Yes! I can think of several markets that would consider the home with a 15+ year old roof. This is especially if the roof is tile or architectural shingle. Anymore though, at least in the newly coined “SOLO” counties (Seminole, Orange, Lake, Osceola) underwriting eligibility has become very tight. If you have a tile or metal roof there should be some carriers available. If it’s ANY kind of shingle, I’m currently aware of only one top tier company offering top tier coverage if your roof is 15+ years old. It happens to be a major national household brand too! A 93 year old company that is also a Fortune 100 (meaning very stable and reputable). Give us a call to discuss!

Thanks,

Peggy Chaney

January 16, 2020Whom is the company that insures a 30+ yr old roof?

Jason Levine

January 17, 2020Hi Peggy!

As far as Personal Insurance companies in Florida go, I am currently unaware of one that would insure a 30+ year old roof under any kind of policy that would be worth your premium dollars. The answer to this question was different a mere 6-12 months ago, but the marketplace is tightening and hardening under pressure. I believe that 2020 will be a very critical year in determining what having Personal Property Insurance is like in Florida. If we can stop the fraud and abuse largely perpetrated by unscrupulous contractors and a well-known roster of attorneys things can go back to normal. If not, we can expect to have a consumer experience statewide that mimics what has been going on in Tri-County (Palm Beach, Broward, Miami-Dade) for a decade or so now. That means a low supply of mediocre coverage full of exclusions and coverage gaps at very high prices. Someone with a roof that is 30+ years (no matter its condition) will likely be forced to residual markets like Citizens Property Insurance Corp. or the Excess & Surplus Lines marketplace.

Thanks for reaching out!

Jason Levine, MS, CPCU

Todd Smith

January 9, 2020Great article!

How long are metal roofs expected to last in the eyes of an insurance company?

Jason Levine

January 17, 2020Hi Todd!

Thank you for reaching out. Your question is a good one, and there is no one universal answer. Here in Florida metal and tile roofs are typically expected to last significantly longer than shingle roofing systems. That said, under current market conditions and underwriting eligibility restrictions we’ve seen the long standing days of 15 years for standard shingles, 20 years for architectural shingles, and 30 years for tiles and metal (no matter that 50 year warranty) disappear. Many companies are no employing 10-15 year age requirements for all roofs, and some are even restricting new business to homes constructed in the last 10 years or newer.

It is largely thanks to Assignment of Benefits abuse, and out of control claims costs thanks to attorneys and unscrupulous contractors. Hopefully, we can get some legislative relief through Tallahassee this year. We’ll see.

The answer to your question: It used to be 30 years as a standard practice. Now, it’s varies by insurance company and is often quite less based on their claims experiences.

Thanks!

Jason Levine, MS, CPCU

Richard Webb

December 29, 2019How do underwriting guidelines handle elastomeric coating over white barrel tile?

How long will some companies extend coverage past 30 years?

Jason Levine

December 30, 2019Hi Richard,

Thanks so much for reaching out. Unfortunately, a roof coating is not going to be considered in the estimation of roof life by any insurance company that I am aware of in the Central Florida marketplace. The elastomeric coating may be a fabulous tool to extend service life, and it may be a true indicator of pride of ownership. It is not something that has any sort of general underwriting provisions around it though, so other than attempting to talk underwriters into accepting a risk with a 30+ year old roof with said coating on a case by case basis it doesn’t move the needle.

Unfortunately, as the market conditions in Central Florida further devolve into a facsimile of those in the Tri-County area (Palm Beach, Broward, Miami-Dade) roof age requirements are becoming tighter and tighter numbers (as low as 10 years from some carriers on shingles now). A 30 year old tile roof is considered beyond its serviceable age by all of the markets – EXCEPT FOR ONE – that I am aware of. Others may consider properties with 30+ year old roofs for coverage, but they’d almost certainly include restrictions that exclude all Water Damage, and they would likely value the roof on an Actual Cash Value basis (depreciated and near worthless) value versus a Replacement Cost basis (typical new for old).

Sorry I don’t have better news.

Thanks!