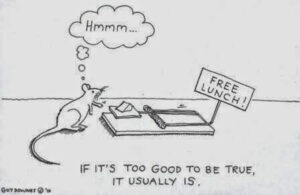

If it’s too good to be true, it probably is.

A stranger knocks on your door. You apprehensively answer. They tell you that they can get you a entirely kitchen worth $25,000 or more if you’ll let them inside. You laugh, say it’s too good to be true and send them on their way. So why do people allow those making such outrageous claims to climb on their roofs, have access to their insurance policy information, and ultimately to involve them in a rapidly growing fraud scam? I suppose it’s because they aren’t be asked to actually invite the perpetrators in, but they are being promised a new roof typically valued anywhere between $10,000 and $40,000.

Insurance is there to protect homeowners from sudden and accidental damage. Unlike a home warranty or maintenance contract, insurance does not cover wear and tear or an item reaching the end of its useful life. Insurance is designed and priced to repair or replace a roof if a tree falls on your house, a hail storm causes damage or another sudden, accidental and unforeseeable event damages your home. Unfortunately, opportunistic and criminally liable contractors are looking for homes with shingle roof at or around 15 years old all over Florida. These roofs are naturally reaching the end of their lives, and most homeowners dread having to purchase one from within their household budget. Knock, knock…

The scam goes like this. Bad contractors target neighborhoods. They began knocking on doors saying they’re doing free roof inspections. There was a hail storm several weeks to several months ago and they’ve been finding lots of damage in your area. Concerned homeowners do not refuse the inspection. The contractors are then faking damage by wearing metal sports cleats and stomping across the top of your house, using marbles/hammers/nails/etc. to manufacture damage. Sometimes they’re simply saying there was damage and begin demolition instantly so that your insurance adjuster never sees the damage and must still pay. The homeowner gets a new roof, the contractor gets an inflated fee and the insurance company is forced to pay even though no insurable event has actually occurred.

This set-up has become so common that I’m surprised when a day goes by that I don’t see a claim reported for wind/hail damage caused 3-6 months ago but just now being reported. What is worse is that many of the contractors are using a contractual trap called “Assignment of Benefits” that actually cancels the homeowner’s right to deal with their own insurance company. That’s right. It assigns 100% of the homeowner’s rights to the contractor. The owner is left with zero control or involvement.

- When people ask why their homeowner insurance is always going up now you know one of the main reasons. If a fraudster knocks on your door and promises you a new roof that costs more than your car, it is too good be to true. All those contractor yard signs in the neighborhood make it tempting, but realize that you are signing on the dotted line for market instability and increasing rates. Of course, if you’ve noticed a roof leak recently and the storm was the other day you probably need a roofer! When they are coaching about a storm from half a year ago and you haven’t noticed any leaks or other problems, you’re probably being misled.

- You is shared on CLUE (Comprehensive Loss Underwriting Exchange) no matter who your insurance company is. These claims can be seen by all, so if you go to change your policy in the next year your two these contractor initiated claims may come back to haunt you. It depends on the exact circumstances, but you could even be ineligible for coverage with other companies.

Insurance is there to help you when things go wrong. It is not there to replace new building systems when they naturally run out life. In fact, leaving a decaying system to allow for more serious and debatably insurable damage to occur is actually called a morale hazard. It can lead to claims denial, and if you’re found to be complicit with a crooked contractor you’ve actually committed a crime. Take care of your home and report signs of damage and problems to your agent to discuss if filing a claim is the right thing to do as soon as warning signs appear.

If a contractor comes knocking and chatting about lots of damage in the area slam your door shut. Call an independent contractor to conduct an inspection for you, but get the door to door fraudster off your property as quickly as you can!

Save