Having a Certificate of Insurance is essential as a business owner.

But what is a COI (and how do you read it)?

If you are a small business owner, you are probably aware that you need a Certificate of Insurance (COI).

You might have been asked to provide one by a savvy consumer or potential landlord. Or perhaps your independent insurance agent advised that you have one.

Or you may not have the slightest clue what it is.

As Central Florida-based independent insurance agents, we not only know what a Certificate of Insurance is, but we’re also used to answering questions about them. Let’s answer some of your top questions about your Certificate of Insurance.

If you’ve ever wondered “What is a COI?” or “What do all these numbers and letters mean?” allow us to shed some light on this important document.

What is a COI?

A Certificate of Insurance (COI), also known as a Certificate of Liability Insurance—or “Proof of Insurance“—is simply a document provided by your insurance company that verifies and describes your coverage with them. As a business owner or independent contractor, you can request a COI for multiple types of business insurance—general liability insurance, business insurance, auto insurance, and more.

It isn’t an insurance policy or your ID cards, but a snapshot of your coverage at the time the certificate was issued. As such, it can be issued at any time.

COIs are based on templates developed by the Association for Cooperative Operations Research and Development (commonly known by its acronym, ACORD) and are available as proof of liability, personal property, and commercial property policies.

Why You Need a Certificate of Insurance

So if your COI is not your policy, why do you need a certificate at all?

When a client requests a COI, they are asking for validation that your business is properly insured. Your Certificate of Insurance acts like a letter of recommendation from your insurance company—complete with its stamp of approval. As a small business owner, it shows potential clients that you have the proper insurance coverage, and it provides financial protection in the case of an incident with your client.

Without it, any shady contractor could lie about having general liability coverage to avoid paying hefty premiums. As you might guess, this could get extremely messy in the event they cause injury or property damage.

How to Read Your Certificate of Insurance

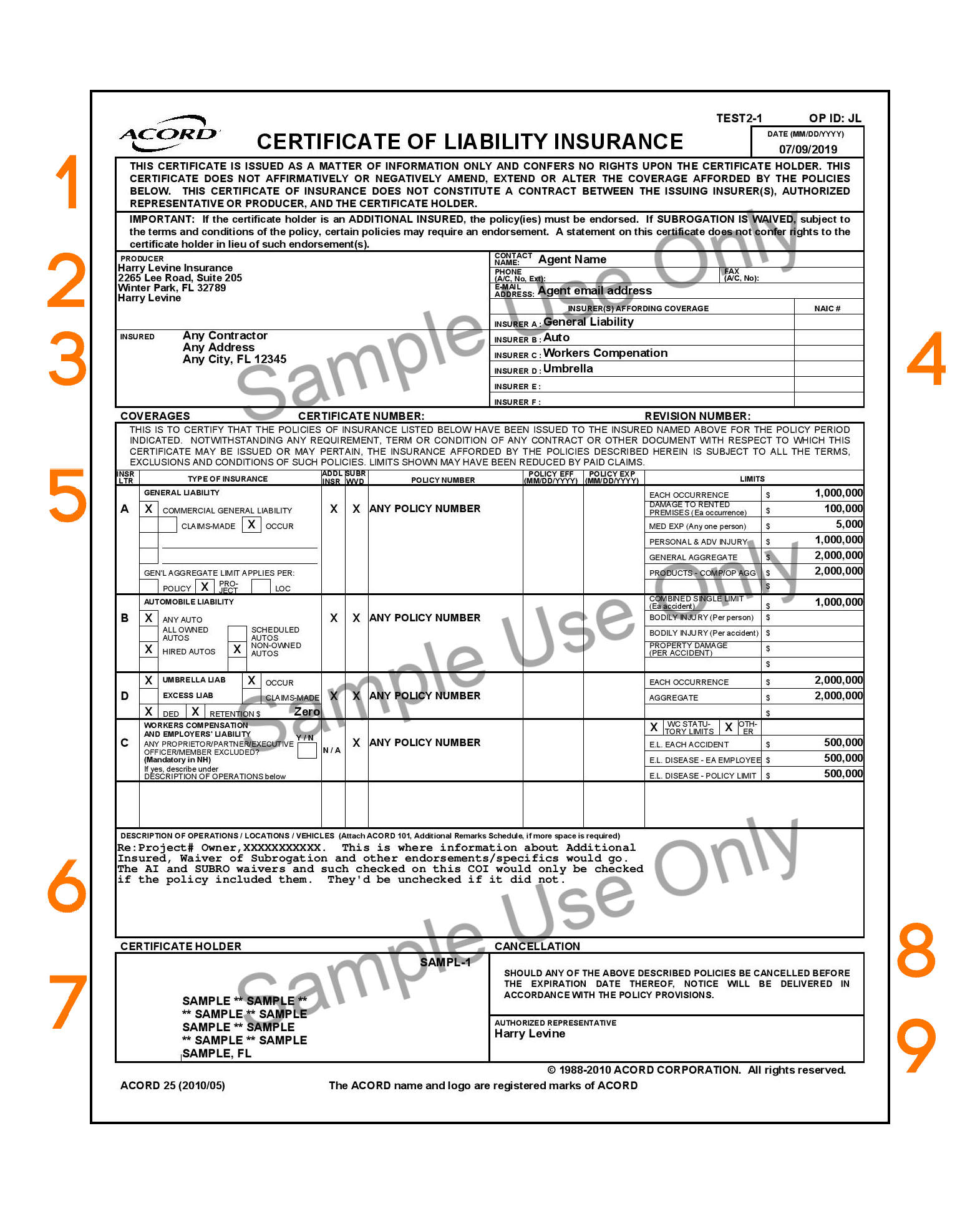

Your Certificate of Insurance can be broken down into nine main sections and each of these sections has a different, yet crucial, purpose.

1. Disclaimer

The disclaimer states that the Certificate of Insurance is merely a representation of your existing coverage and does not “amend, extend, or alter” your policies.

2. Producer

This section will list the name and address of the insurance agent or broker who issued your COI.

3. Insured

The legal name and address of the business or individual covered under the insurance policies described on the COI.

4. Insurers Affording Coverage

This section will list all of the insurance companies that the Insured has policies under. They are listed A through F.

5. Coverages

Your “Coverages” section is the longest, as this is where you will find all of the details of your business insurance coverage, including insurance type, effective dates, and limits. This area is where COIs tend to get a little confusing, so let’s break it down.

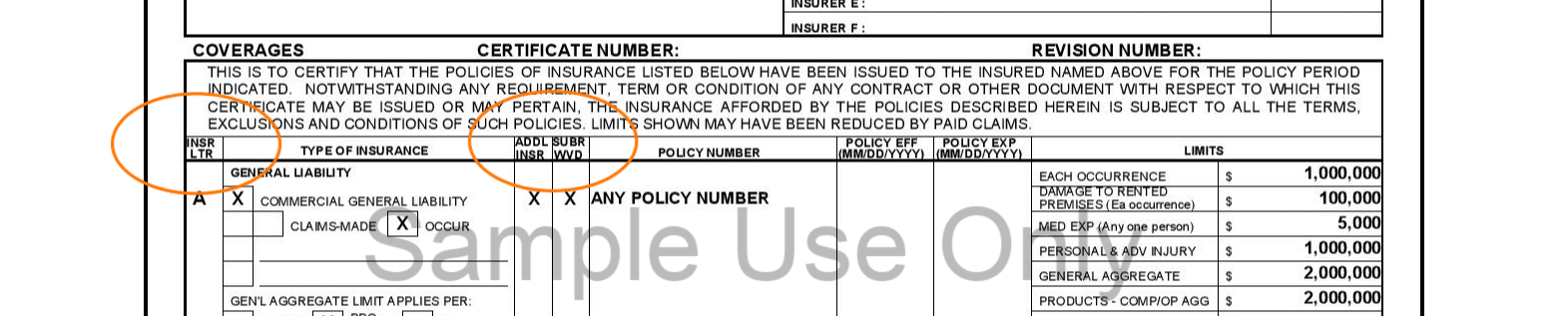

At the far right, you’ll see a column labeled “INSR LTR.” This is short for “Insurer Letter”; the letter you see here will correspond to the Insurer Affording Coverage as described earlier.

For instance, if there is a “B” in this column, it means that the insurance company holding that particular policy is the same insurance company listed next to “B” in the “Insurers Affording Coverage” section.

“Type of Insurance” refers to the type of coverage afforded by policy, whether business liability insurance, auto or fleet coverage, garage, excess, or workers compensation, and more.

Next you’ll see two columns labeled “ADD’L INSRD” and “SUBR WVD.” The first one stands for “Additional Insured,” and an X placed in this column indicates that the person being issued the Certificate is an additional insured on the policy.

“SUBR WVD” stands for “Subrogation Waived” and is a very crucial part of your Certificate of Insurance, especially if you are providing this document as a subcontractor. If the SUBR WVD box is checked off, that means that the insurance company of the named insured will not be able to pursue legal action against specified parties that usually include the Certificate Holder (see #7 above) in the event of a claim, even if they were directly responsible for the damages.

Next listed is the appropriate policy number, as well as the effective and expiration dates of the policy. The last column shows the limits (in dollars).

6. Description of Operations

If there are any specific operations, locations, or projects that the Certificate of Insurance applies to, they will be listed here. This is also where the COI would list information about any Additional Insured or Subrogation Waiver.

7. Certificate Holder

The name and address of whoever is requesting the Certificate of Insurance. In some cases, this may be the business itself; in other cases, it may be their client or another institution.

8. Cancellation

This is another disclaimer that lists the number of days that the insurance company will send notice to the Certificate Holder in the event that any of the policies are canceled before the expiration date listed. Thirty days is standard.

9. Authorized Representative

Your Certificate of Insurance must include the signature of your insurance agent/broker or a representative of the agency.

For more information on insurance terms you need to know, check our guide here.

Get Your Certificate of Insurance

Understanding your Certificate of Insurance is an important part of owning a small business, but if your insurance agent is only telling you which coverages you currently have, you’re only seeing a small piece of the puzzle.

Accidents, shoddy work, negligence, and other claims occur all the time in commercial settings, which is why it’s important to have the right level of insurance coverage.

At Harry Levine Insurance, we’ve been meeting Central Florida’s insurance needs for more than 30 years, and we have the knowledge, resources, and expertise to identify and close gaps in your coverage.

If you’re looking for affordable coverage that meets your needs, request a quote today.

Comments (8)

Anna

October 28, 2023I recently started working for a building company, and I’m now in charge of requesting the updated COI’s for our customers. And now seeing all this explanation I’ve realized that most of the GLI’s that we have been receiving (from our insurance agents) lacks the X on the coverage area. Could this represent a big issue in case something goes wrong?

Julie Levine

November 4, 2023Hi Ana,

Ultimately, what is and isn’t on a certificate has very little bearing on the insurance policy or policies in question. While a missing “X” can have a huge compliance impact between the parties to the contract, a Certificate of Insurance is merely a snapshot of a policy in-place at a moment in time. Effectively, COI’s do not actually substantiate or afford any kind of insurance coverage whatsoever. Thus, whatever is or is not on a COI has no bearing on the actual coverage afforded by the policy. For example, if an COI says that a party is an Additional Insured but the policy doesn’t say so, then said party simply is not Additional Insured (the COI saying so does NOT make it so).

Of course, you always want COI’s to match contractual requirements. They must first match the policy they are providing a snapshot of, and policies don’t always (and cannot always) satisfy all of the requirements that are asked for. Hope that helps!

Thank you,

Jason Levine, MS, CPCU

sharon

June 29, 2023Hi,

I am wondering if in the State of NJ the box SUBRV WVD box is not checked , as I was told in the state of NJ it’s illegal. Can you advise if that is correct

Julie Levine

June 29, 2023Hi,

I am glad you found our blog. We don’t do business in the great state of New Jersey so I am unsure. Try reaching out to a New Jersey agent. Best of luck!

Norvell D Bufford

November 17, 2022I has a tennant, provide me with a Certificate of insurance. Which stated that I was an additional insured and the certificate holder . Months later due to an negligence act by the tennant. The insurance company advised that ” The policy had no additional insured or a certificate holders . Underwriting never received any request to add anyone . The insurance agent procured this document . The insurance company is stating that the certificate of insurance states that the disclosure ” The disclaimer states that the Certificate of Insurance is merely a representation of your existing coverage and does not “amend, extend, or alter” your policies.” The property damage was created by the tenant no obtaining built permits for work he had performed on the property owned by me .

Julie Levine

November 18, 2022Hi Dean,

Thank you for reaching out! In a nutshell, Certificates can be a nightmare. They are ROUTINELY incorrect, so much so that the City of Atlanta stopped even requiring them for a period. Atlanta found them to be next to useless. The situation that you are running up against is very common. If I had to guess, which I am (I have no way of knowing that this is what happened), the person who issued that certificate acted as but a “processor” and did not their complete job. Specifically, they issued the certificate with the requested Additional Insured language. However, they did not check to see if it actually existed, nor did they request for it to be added. It is accurate that a COI does not amend/change/obligate a policy in any way. COI’s are mere “snapshots at a point in time” of a policy, but they do not create any binding coverage. As such, the insurance company has zero obligation to response. The party who issued the erroneous certificate may have some liability. That would be determined by the folks in legal, though!

Good luck!

Jason Levine, MS, CPCU

President & CEO

Robert Hart

December 5, 2021Hello, my name is Robert and I was acting as a member of Sullivan Solar Power when I was storing a work vehicle. I occasionally had to move the vehicle due to street sweeping and was involved in an accident. The insurance company told me that the truck was not covered but I have a copy of the Certificate of Liability Insurance that is dated: “policy Eff. 5/11/2021-policy Exp.5/1 2022. Did the producer lie?

Jason Levine

December 6, 2021Hi Robert!

Thanks for reaching out. In order to best advise you I would need a lot more information. Coverage determinations are made not only by confirming that a policy was in-force at the proper time, but also by reviewing what coverage and exclusions were specific to that policy. The details of the loss/claim itself matter tremendously too. I’d be happy to review your situation with you. Thanks!