Wind Insurance

For Your Home

The average home insurance policy isn’t right for every Florida homeowner. In fact, certain dwellings along Florida’s extensive coastline may have a difficult time getting the coverage they need from a single homeowners insurance policy.

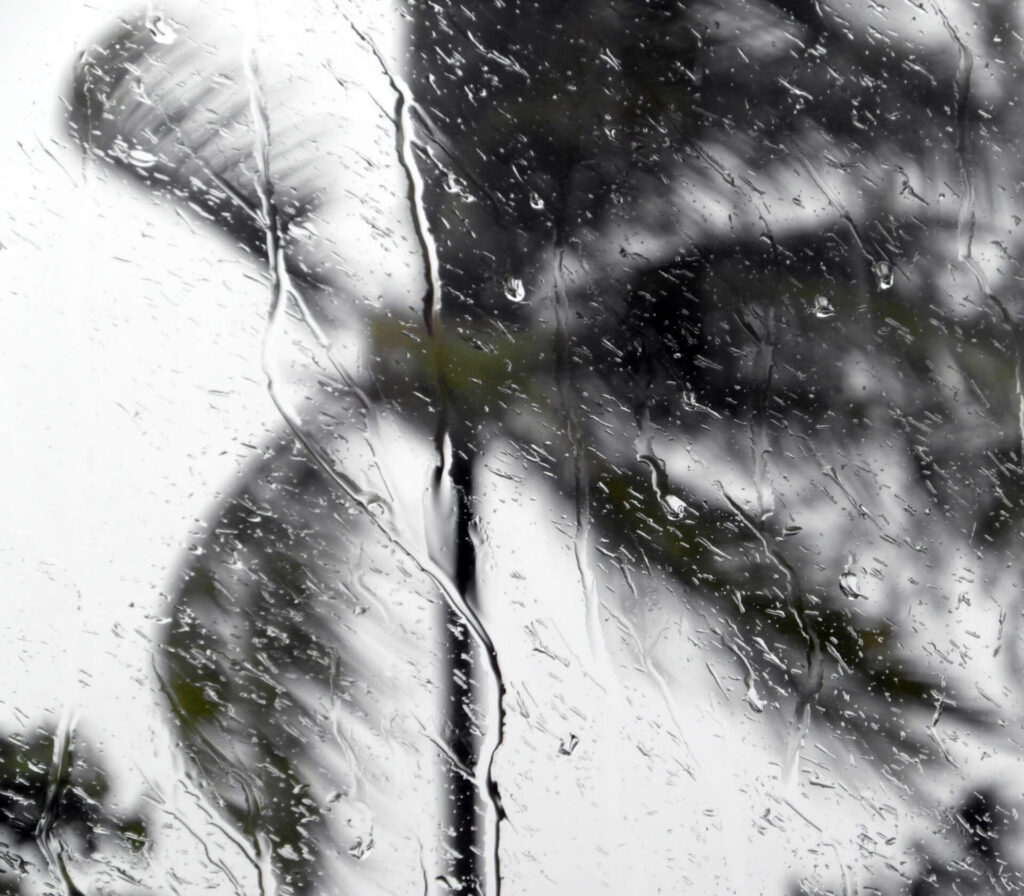

The Sunshine State’s extreme weather swings between the warm, sunny days we’re famous for and some of the most devastating storms ever seen. Hurricanes, tropical storms, tornadoes, and even summer thunderstorms contribute to billions of dollars in damage each year.

Needless to say, this is one type of homeowners insurance coverage that you do not want to go without.

If wind insurance is not included in your insurance coverage, let Harry Levine Insurance connect you with a policy that fits your needs and your budget.